Casual observers of Tuesday’s Senate hearing about the much-discussed U.S. Virgin Islands housing shortage may have found themselves slightly dizzy. Not only was the expert testimony voluminous and highly detailed, it was also circular in nature.

The 2017 storms damaged large swaths of public and private housing. Emergency repair crews flown in from off island helped right things but needed a place to stay, exacerbating the housing crunch. Federal money to assist ongoing repairs was tied to spirals of bureaucracy — and efforts tied to the money were outpaced by more nimble non-profit groups. More funds from Washington helped put public housing, schools, and other government structures on a path to repair but this overburdened the limited general contractor pool, which quickly came to distrust such projects because payments for their work lagged behind the 30-day threshold agreed upon. Meanwhile, cash-strapped homeowners moved off island and rented their pieces of paradise to vacationers eager to pour their holiday savings into rum punch and Live-Slow-Sail-Fast T-shirts but were unable to find a hotel room — because hotels damaged by the storms of 2017 were still offline.

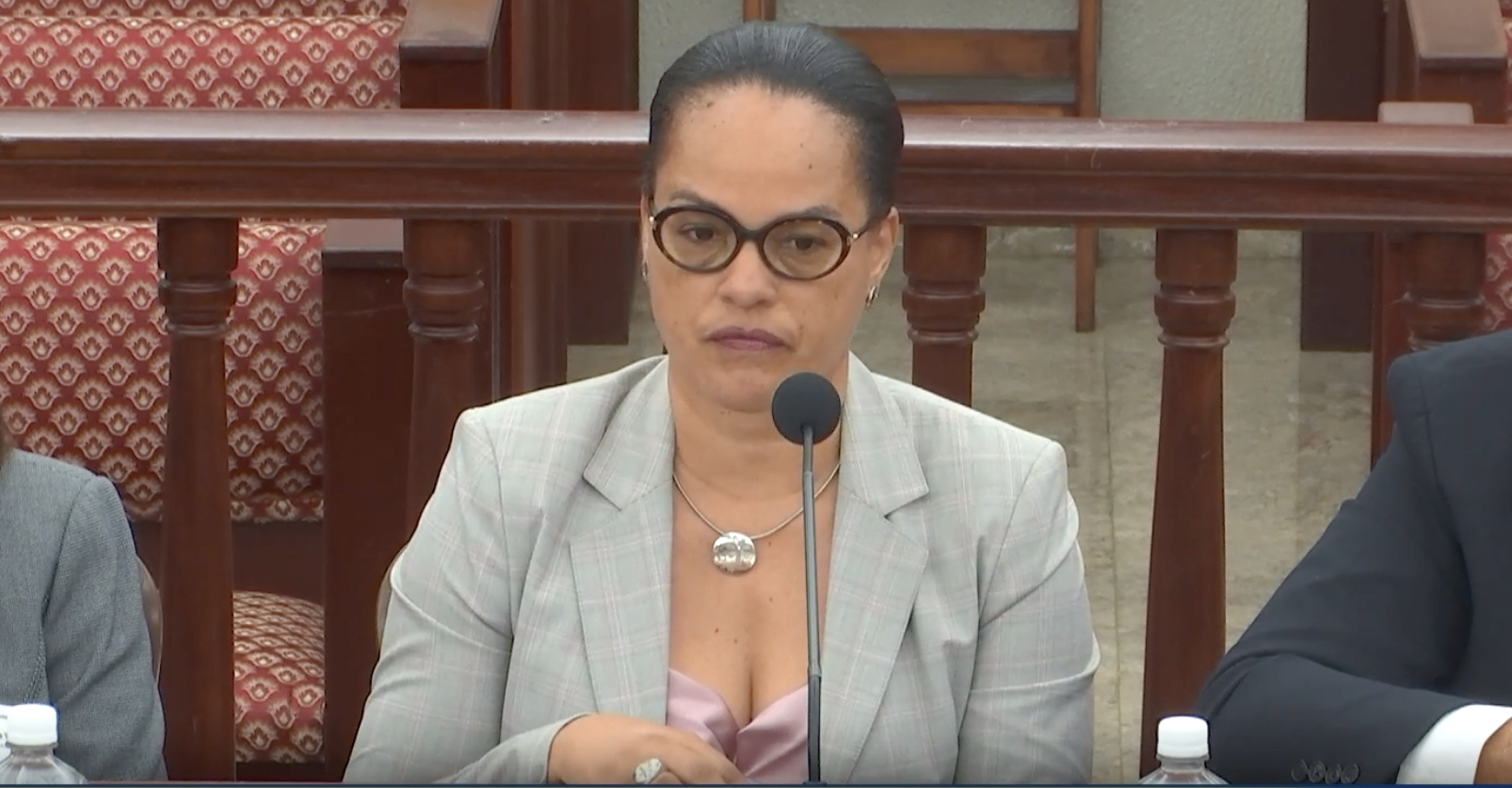

Sen. Donna Frett-Gregory asked the blunt question: “What is it that really, truly needs to happen to move the needle on this?”

Stephanie Berry, chief operation officer of the Virgin Islands Housing Finance Authority, had an impassioned answer.

“Workforce, contractors, education. Those three. I can come before you in every session and say in the first quarter of next year we plan to solicit for two major projects that will add 20 homes in the territory. And if I have contractors that are already maxed out with other obligations, or they are thin as it is with their workforce, there is nothing that I can say that will build those 20 homes.”

The education aspect had to do with advocating financial literacy, spreading knowledge of how mortgages and home buying works, and financial planning, several senators said in the St. Thomas hearing.

But it wasn’t just potential home buyers in need of a reality check, Frett-Gregory implied. The senator had met with mainland counterparts from eastern states over the summer and found similar needs but dissimilar responses, she said.

“The housing crisis is not unique to the Virgin Islands. What’s unique to the Virgin Islands is that we do not have a plan. Those states that I sat with, they could tell you what their needs are, where they’re placing specific communities, and where they still have a delta,” she said, using corporate slang for an unknown variable.

Berry said solving the housing crisis was larger than looking at the housing crisis.

“The plan has to be realistic about, at least from a construction standpoint, how many projects are actually going to get off the ground, and when, and where,” she said. “We really need to sit down as all stakeholders and we bring our individual plans to the table.”

Building new houses, especially higher-density housing, has a ripple effect on schools, traffic, commercial interests, utilities, and other infrastructure. Berry visualized each government department in the same room, finding a data-driven, well-planned solution that made sense in the long run.

“If we had a map of St. Thomas and the different districts, and we said, Education, where are your schools going? Housing Finance, where are your houses going? Public Works, which roads are you fixing? WAPA, where is your infrastructure going to be improved? Where are your challenges?” she said.

She grew even more passionate when addressing plans to expand housing in areas of St. Croix where municipal water has been found to contain extraordinarily high concentrations of copper and lead.

“How can we have a plan to add 12 new homes on Mount Pleasant when we have this potable water issue going on in St. Croix district? How can we say as stewards of fiscal funds that I’m going to assist you get into your first home, assist you by getting you connected to public water system that have been compromised,” Berry asked. “It has to be a realistic conversation, senator, where we’re putting all our dirty laundry on the table. An elephant can be eaten but it has to be eaten one bite at a time.”

Some of that dirty laundry includes stumbling on both sides of the contractor payment argument, said Dayna Clendinen, interim executive director and chief disaster recovery officer for the Virgin Islands Housing Finance Authority. The cost of building materials and, especially, labor have recently exceeded the authority’s estimates, leading to sticker shock. But these payments can’t be made if forms aren’t filled out correctly by the payee.

“One of our biggest challenges has been submittal of incomplete payment packages from contractors, which prevents us from being able to process payments,” Clendinen said.

While the VIHFA’s EnVision Tomorrow project managed to rebuild 27 damaged homes since 2019, the St. John non-profit Love City Strong has repaired 37 since 2018. Senators were aghast at the disparity, but both Clendinen and Love City Strong Executive Director Meaghan Enright agreed it was not an equal comparison. The Housing Finance Authority is beholden to local and federal red tape — assessing more than 620 applications potentially eligible for the program — Love City Strong is not so encumbered.

“Indisputably, housing is one of the most challenging sectors to address in any disaster recovery process. Love City Strong believes that proactive, mitigation-led recovery strategies will help St John and the greater U.S. Virgin Islands to remain resilient in the face of future hurricane impacts and that public/private partnerships are the most efficient and effective means to that end,” Enright told the Committee on Housing, Transportation and Telecommunications.

Senators also decried the slow pace of V.I. Slice — a gap funding program meant to help would-be home buyers or builders overcome funding shortfalls. They asked restrictions on income and other requirements be lessened to allow more Virgin Islanders to qualify.

Wayne Biggs Jr, CEO of the Economic Development Authority, said such changes likely weren’t possible as the mortgages need to comply with industry standards.

“As of today, eight V.I. Slice homeownership transactions have been approved totaling $614,757.95 in gap financing with overall bank financing of $2,196,641. Of this total, six have been approved for St. Croix totaling $397,4323.23, and two for St. Thomas totaling $217,434.72,” Biggs said. “VIEDA continues to recruit additional lenders to participate in the V.I. Slice Program. We will be sending introductory letters to approximately 40 lenders licensed in the territory. Additionally, we will continue our aggressive marketing initiatives to include town hall meetings, radio and newspaper advertisements.”