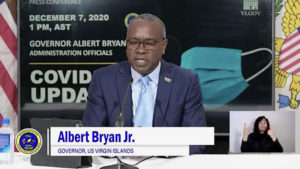

Attempting to create public buy-in before the V.I. Senate convenes in special session on Tuesday, Gov. Albert Bryan Jr. spent half of his news conference on Monday dispelling myths surrounding a bill for securitizing the territory’s matching fund debt that would bring upward of $200 million into the territory over the next three years.

Bryan submitted the bill on Aug. 11 and called a special session for Aug. 18. That session was postponed after the Legislature was shut down due to Sen. Kenneth Gittens disclosing he had tested positive for COVID-19. A session was again called for Dec. 3 but pushed back to Dec. 8.

The proposed legislation creates a special semi-autonomous, government-owned corporation to which the government would sell the rights to as much as $200 million per year in federal alcohol excise tax revenues Congress remits to the territory each year. Bryan has said taking control of this stream out of government hands will create the cash infusion needed to save the Government Employees’ Retirement System and an ongoing cache of funds for future projects.

If approved, the governor has added that the bill, “marks the USVI’s reentry into the bond market for the first time in 11 years,” and “can potentially create a revenue stream of $85 million for each of the next three years by reducing the territory’s annual debt service payment.”

During Monday’s weekly news briefing, Bryan said even without the ongoing situation with GERS, the government would still move ahead with the proposal as it presents a good opportunity to simply save some money.

“This is not the full fix to GERS,” he said. “This is one part of several different measures we’re doing at the same time, but it presents an immediate opportunity we would pursue even if GERS wasn’t in crisis.”

GERS is facing the likelihood of slashing payments to retirees within the next two to four years because for years it has been paying out more than it takes in and has been selling off its assets to make up the difference. Those assets are now all but gone.

See: “The GERS Collapse, Part 1 –

How Bad Is it and How Did We Get Here?”

Bryan added that the proposal also would not increase the government’s indebtedness, but rather gives the territory a chance to “realize savings on interest and reduce how much we pay to our bondholders.” Addressing concerns that the government is also giving up its “lockbox,” or cash management service through which payments are processed, the governor explained that the creation of the special corporation offers a secondary lockbox, which would pay bondholders, then remit the difference to the government.

“The deal is so good, and it makes so much sense that even our co-bondholders, Cruzan and Diageo, are giving the lion’s share of their savings – 70 percent for one and 60 percent for the other – to the Virgin Islands,” Bryan said.

Meanwhile, the third-party corporation is authorized to do nothing else but issue the notes and be accountable to both the legislative and executive branches.

“The Legislature can approve to appropriate these savings however they choose,” the governor said. “I can approve it, and if I don’t, they can override me. But, the first and best use of these savings is to provide an immediate infusion of cash to GERS. This helps us avoid the cut in retirement pensions that could be on the horizon.”